How to Process a Supplier Credit Note

- Click Purchases.

- Select Purchase Credit Notes.

- Click the blue Create Credit Note button.

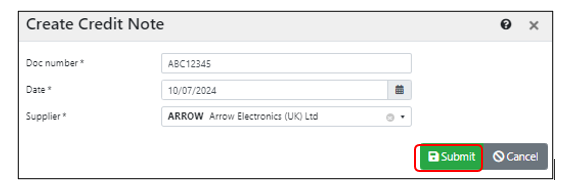

Create Credit Note Modal

- Complete the create credit note modal.

- Enter the credit note number in the Doc number box. This is a required field.

- Click in the Date box to select the credit note date.

- Select a Supplier.This is a required field.

- Click Submit.

- Click the blue Add Credit Note Line button.

New Purchase Ledger Line Modal

- Complete the new purchase ledger line modal as required.

- Enter the Stock Item. This is a required field.

- Enter a positive Quantity number. This is a required field.

- Add a positive Unit amount. This is a required field .

- Select a Tax rate.

- Click the Add extra description box.

- Enter the reason for the credit note.

| IMPORTANT: Do not add a - before the quantity or amount as this would change the credit to an invoice. |

- Click Submit.

- Check the details match the Supplier credit note.

- To edit Details click the right-hand pencil.

Edit Invoice - x Modal

- Edit the Edit Invoice - x Modal as required.

- Click Submit.

-

Check that the totals and VAT amounts match the credit note.

• If the VAT does not match, check and edit VAT by clicking the Edit button to the right of each stock line.

Edit Purchase Ledger Line Modal

• Click on the Tax rate drop down to select the correct VAT rate.

• Click Submit.

-

If everything is correct click the green Post button. The credit note will be posted to Quickbooks.

| IMPORTANT: Posting a credit note to Quickbooks can not be undone - ensure everything is correct before clicking the Post button. |

- Scan and upload the PDF credit note to the Files section, follow the process Uploading/Viewing files.